MohammedAmin.com

MohammedAmin.comSerious writing for

serious readers

Inability to deposit funds with the central bank, or to borrow from the central bank, makes Islamic banks treasury management more difficult. After explaining the issues, this page gives the background to the consultation and reproduces my response to the Bank of England.

Summary

11 March 2016

From the time they were first set up, UK Islamic banks have faced an impediment that conventional UK banks do not face.

Conventional banks can place surplus funds with the Bank of England (BoE), where they:

While the BoE has never prohibited Islamic banks from making interest earning deposits with it, such deposits would of course not be regarded as permissible for Islamic banks by the scholars who advise them on Shariah issues.

As long ago as 13 April 2011 I wrote about the problems of "Liquidity management at UK Islamic banks."

The Bank of England recently issued a consultation paper "Establishing Shari’ah compliant central bank liquidity facilities." Responses are due by 29 April 2016.

I used my March monthly "Letter from Amin" column in Islamic Finance News to explain the background. That is reproduced below. Below that I have published the consultation response that I sent to the Bank of England.

If the issues are relevant to you, or if you have a technical contribution to make, I recommend responding to the consultation request.

As befits the home of the world’s leading international financial centre, for over a decade the UK has been the pioneer amongst Muslim minority countries in facilitating the development of Islamic financial institutions. Its general policy has been to adapt tax and regulatory law and practice with the goal of establishing a “level playing field.” Islamic financial institutions should not be treated any worse, nor any better, than conventional financial institutions.

Where the UK has led the way, many other Muslim minority countries have followed. Some have adopted the UK’s general principles while others have virtually copied the UK’s legal drafting! The UK’s goal of “levelling the playing field” has not yet been achieved. Sadly, the complexity of the issues involved and the other demands upon the time of legislators and regulators mean that this is an ongoing process which will take many years to complete.

All conventional banks have some common treasury management requirements. As many of their liabilities are repayable on demand, banks need to hold a significant proportion of their assets in a form that is safe from credit risk and can be accessed quickly while still earning some interest. They normally achieve this by holding deposits with the country’s central bank. Indeed, most central banks require commercial banks to hold specified levels of such deposits for regulatory purposes. From time to time some banks find that they are unable to finance themselves from regular customer deposits and interbank deposits. They therefore need to be able to borrow from a “lender of last resort.” This function is a key role of the central bank.

Islamic banks have exactly the same treasury management requirements as conventional banks. While Islamic banks do not deposit money at interest or borrow at interest, they need to be able to carry out transactions with the central bank which have equivalent economic effect and which are Shariah compliant.

In the UK, Islamic banks have operated for the last 10 years without such Shariah compliant facilities being offered by the central bank, the Bank of England. This has made managing their treasury functions much more difficult than would have been the case if they had the type of access to the Bank of England, outlined above, which conventional banks have.

In February 2015, speaking at the University of Warwick, Dame Nemat Talaat Shafik DBE, Bank of England Deputy Governor for Markets and Banking, said “The Bank will commence work in the second half of 2015 to assess the feasibility of establishing a Shari’ah compliant facility. By providing an additional highly liquid asset for Islamic banks, such a facility would be a significant step forward in their liquidity management capabilities.”

A year later, this work has moved a step forward. Last month, the Bank of England issued a consultation paper “Establishing Shari’ah compliant central bank liquidity facilities” which is available from its website. This proposes two alternative models intended to allow Islamic financial institutions to make the equivalent of deposits with the central bank in a Shariah compliant way. While enabling such deposits will be the initial goal, the paper also sets out two alternative models which might be implemented at a later date for the Bank of England to act as a lender to Islamic banks. The deadline for responses is 29 April.

I have submitted a personal response which I will publish on my own website www.mohammedamin.com in the near future.

2 March 2016

By email to: islamic.finance@bankofengland.co.uk

Shari’ah Compliant Facilities Project Team

Sterling Markets Division

Bank of England

London

EC2R 8AH

Dear Sir

Establishing Shari’ah compliant central bank liquidity facilities

Consultation Paper February 2016

I am writing in response to your consultation paper. I confirm that the Bank of England (BoE) is free to publish this response, including the PO Box address if desired, in full. However, the email address I will use to transmit the response to you should not be published.

I am an Islamic finance specialist, with a particular interest in how Islamic finance is treated in Western tax and regulatory systems. Until I retired at the end of 2009 I led PwC’s Islamic Finance practice in the UK as well as being a member of PwC’s four-person Global Islamic Finance Leadership Team.

I was an original member of the HM Treasury Islamic Finance Experts Group, established by the Economic Secretary to the Treasury in April 2007 to advise the Government on Islamic Finance strategy, and remained the only practicing accountant on that group until it was discontinued shortly before the 2010 General Election.

I was the lead researcher and principal author of the report "Cross border taxation of Islamic finance in the MENA region Phase One" which was published on 13 February 2013 by the Qatar Financial Centre Authority.

More information about me is available on my website www.mohammedamin.com

The Consultation Paper addresses an important issue.

Islamic banks operating in the UK need to be able to hold liquidity buffers for prudential reasons. However, there is a severe shortage of eligible assets for them to hold. Accordingly, it is highly desirable for the BoE to establish facilities for UK Islamic banks to place funds with the BoE on terms which have the same economic consequences as deposits which conventional banks place with the BoE.

There is a similar need for other regulated Islamic financial institutions operating in the UK to be able to place funds held as liquidity buffers with the BoE.

Looking further ahead, the paper envisages that later in the process the BoE may establish liquidity facilities enabling UK Islamic banks to obtain funds from the BoE in a Shariah compliant way on terms similar to those offered to conventional banks where the BoE provides liquidity to the money market. This is also highly desirable as at present UK Islamic banks do not have a Shariah compliant “lender of last resort.”

I am not involved in the management of any of the UK’s Islamic banks. Accordingly, this response only addresses some of the questions the BoE asks in the consultation document.

Furthermore, although I regularly think about the religious issues involved in Islamic finance, it is my practice not to give religious advice to other people. Accordingly, this letter offers no views on Shariah compliance. In my view the Shariah Supervisory Board of each UK Islamic bank will need to decide for itself whether it regards the proposals, if implemented, as being Shariah compliant.

Questions 1 – 3: No response.

Question 4: The question of hedging requires closer consideration in my view.

In my opinion the way that hedging activities will be regarded by the Shariah Supervisory Board of a participating bank may be influenced by where the hedging takes place, and by which party is the economic beneficiary of the hedging.

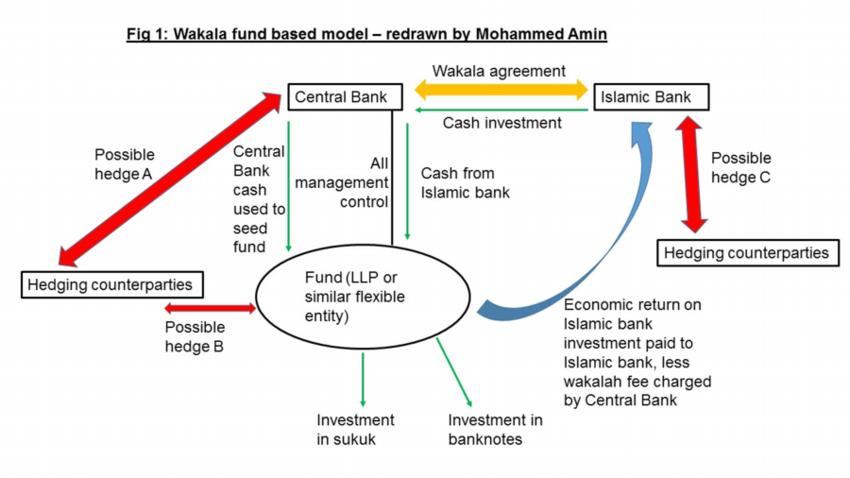

To illustrate the above point, I have re-drawn Figure 1 from section 3.1 on page 9 of the Consultation Paper.

My re-drawn version “Fig 1: Wakala fund based model – redrawn by Mohammed Amin” is below.

Conceptually there are three possible places where hedging could take place:

As indicated above, before one can consider where and how the hedging is done, one needs to decide the exact terms of the wakalah agreement between the Central Bank and the Islamic Bank. The consultation document does not set out the full terms of the wakalah agreement envisaged, but some of the paragraphs in section 3 give a broad indication.

Paragraph 3.1 states that the fund “would pay a profit rate to participants based on the return from the assets in the fund. An expected profit rate would be indicated at the start of the investment, but this would not be guaranteed.”

Paragraph 3.2 states “While the deposits would have a contractual maturity date, break clauses could allow them to be terminated early if the funds were required to meet an unexpected liquidity outflow.”

Paragraph 3.4 states “The wakalah model would entail the Bank taking on financial risk, which it could choose to hedge. The financial risks on the portfolio include both interest rate and FX risk, as most sukuk are denominated in US dollars, but the fund would have sterling liabilities to the Islamic banks.”

The above paragraphs assume that when the Islamic Bank makes an investment into the wakalah fund, in sterling, the full sterling amount of that investment is guaranteed to be returned on the maturity date. Accordingly, the only risk to the Islamic Bank is that the return on the investment may be below the expected profit rate. However, that the return could not be negative. (Neither the consultation paper nor this response considers the possibility of an environment where short-term interest rates became negative.)

While at PricewaterhouseCoopers one of my client Islamic banks shared with me their standard interbank wakalah agreement. Client confidentiality meant that I did not retain a copy after I retired from PricewaterhouseCoopers, and it would be unreliable to depend upon my memory of the contents of that agreement.

I assume that the BoE has reviewed the wakalah agreements that Islamic banks use in the London interbank market and that the indicative statements in paragraphs 3.1, 3.2 and 3.4 are based upon that review.

The Association of Islamic Banking Institutions Malaysia does publish its own model “Corporate Wakalah Placement Agreement”. If one visits their website, it should be available on the page

http://www.aibim.com/index.php/research-publication/2015-12-07-06-13-54

However, at the time of writing there appears to be a problem with AIBM’s website’s downloadable publications page because all of the links on that page described as “Wakalah” actually lead to their “Corporate Murabahah Master Agreement.” Nevertheless, their model wakalah agreement is available elsewhere on the AIBM website at the link

http://aibim.com/dev/images/PDF/CWPA.pdf

Under section 4 of the AIBM model agreement, the most that the principal can receive is the Anticipated Profit less the Wakil Fee, but the principal is fully liable for losses.

Obviously such provisions would be inconsistent with the way that interbank deposits work in the London money market in the absence of the insolvency of the deposit taking bank.

This response continues with the assumption that under the terms of the envisaged wakalah agreement between the Central Bank and the Islamic Bank, the Islamic bank would be entitled to the return of its deposit on the maturity date in full, and that its only exposure would be to the actual return on the wakalah fund falling below the anticipated return, but that the Islamic Bank could not make a loss on the transaction.

With those assumptions, either Hedge A or Hedge B would be required to ensure that Central Bank was not left bearing a loss due to paying out the full investment made by the Islamic Bank at a time when the wakalah fund had a total return that was negative.

In passing, the consultation document in paragraph 3.4 only mentions interest rate risk and foreign exchange risk. While there would be no risk of any kind on the investment in bank notes, the investment in sukuk also carries default risk unless the sukuk are ultimately underwritten by the credit exposure of a sovereign that Central Bank regards as free from any risk of default.

The choice between Hedge A and Hedge B depends critically on the precise language of the wakalah agreement between Central Bank and Islamic Bank. While many versions of the language are possible, just two alternatives are considered below to illustrate the issues:

I make no assumption regarding the Shariah compliance of either of the above alternative contractual wordings.

In scenario (1), it is Central Bank itself that has taken on the responsibility of guaranteeing the return of the original investment. Islamic Bank has no legitimate grounds for investigating how Central Bank manages that risk. For example, if Central Bank considered the risk an acceptable one to bear, it might take out no hedges at all. More likely, Central Bank would enter into Hedge A as outlined in the diagram above, and the Shariah compliance or otherwise of that hedge should be irrelevant to Islamic Bank.

In scenario (2) the hedge obviously needs to be taken out by the wakalah fund, Hedge B in the diagram, and this hedge needs to be regarded as Shariah compliant by Islamic Bank.

Question 5: No additional comments.

Questions 6 – 10: No response.

Questions 11 – 13: No response.

Questions 14 – 15: No response.

Question 16: No response.

If you would like me to expand on any of these comments, either in writing, by telephone or in person, please do not hesitate to contact me.

Yours faithfully

Mohammed Amin

Follow @Mohammed_Amin